What is Proof-of-Stake (POS) and how it works?

Proof-of-Stake (POS) is a mechanism that maintains the integrity of the blockchain network. It was created in 2011 as a more energy-efficient alternative to the Proof-of-Work (POW) mechanism.

Table of contents:

- What is Proof-of-Stake (POS) mechanism?

- How Proof-of-Stake (POS) works?

- Proof-of-Work vs. Proof-of-Stake - advantages and disadvantages

- Which cryptocurrencies use Proof-of-Stake (POS) mechanism?

- 3 main advantages of the Proof-of-Stake mechanism

- 3 main disadvantages of the Proof-of-Stake mechanism

- 3 frequently asked questions about proof-of-Stake (POS)

Although people think of it as a “new” consensus mechanism in the blockchain network, the Proof-of-Stake mechanism was actually introduced in 2011.

At that time, Sunny King and Scott Nadal published a paper in which they presented a new mechanism that can successfully maintain the integrity of the blockchain network without consuming a large amount of energy like Bitcoin did (as you might already know, Bitcoin uses a mining process (Proof-of-Work) to confirm transactions).

Why is having energy efficient consensus protocol important?

To start, it takes a lot of money to maintain a Proof-of-Work powered blockchain network. Take Bitcoin, for example.

In 2011 the average cost of maintaining the Bitcoin blockchain network was $150,000.

Today, maintaining the Bitcoin network costs millions of dollars.

Let’s take a step back for a moment. Why does a blockchain network need a consensus mechanism in the first place?

In order to understand Proof-of-Stake features better, it is necessary to know what the consensus mechanism is and how it came to life thanks to the Proof-of-Work concept.

You can find that information in our previous blog with infographics written specifically for beginners:

What is Proof-of-Work? The definition, features, and benefits

What is Proof-of-Stake (POS) mechanism?

Proof-of-Stake (POS) is a type of consensus mechanism that helps blockchain networks maintain normal functions (transaction monitoring, confirmation, and saving) without the need for a central authority.

Many new blockchain projects today opt for Proof-of-Stake instead of Proof-of-Work because it offers:

- better energy efficiency

- a higher chance of becoming a validator

Better computer equipment here does not guarantee that you will have a better starting position in confirming transactions and receiving a reward in the form of new coins.

How Proof-of-Stake (POS) works?

In order to understand Proof-of-Stake functionalities better, let’s use visual aids and think of the process of confirming transactions and adding new blocks as a car race.

In that race, there are many participants which have a car with different categories.

The rules of the race are simple.

Only the first car that crosses the finish line will receive the prize. Others will get nothing.

If there is only one sports car participating among other regular vehicles, you can expect that the sports car will win every race.

There could be a lucky factor that could let other cars win, for example, the engine of the sports car blowing up.

This type of race where the best machine wins is the analogy for a Proof-of-Work concept.

In other world, people with the best computer equipment have the highest chance of solving the cryptographic puzzle, confirming the transaction, adding a new block, and thus receiving a certain amount of coins.

Since solving cryptographic puzzles is becoming more complex over time, strong devices have even more advantages.

There is almost no chance for a weaker device to solve the cryptographic puzzle.

There were rare occasions when regular computers were able to come up with a solution first, but it was pure luck.

This is what Proof-of-Stake is trying to democratize.

It promotes a more fair approach that will give everyone a chance to become a validator. How does it work?

Let’s use race once again as an analogy.

Not all competitors will participate in this race. Before the race, a car that will participate in the race is randomly selected.

Once the selected car reaches the finish line, it will receive the reward for taking first place.

But there is a catch.

In order for the car to even participate in the race, the driver must first invest a certain amount of money.

The money is, in a way, a guarantee that once the driver is selected, he will actually finish the race.

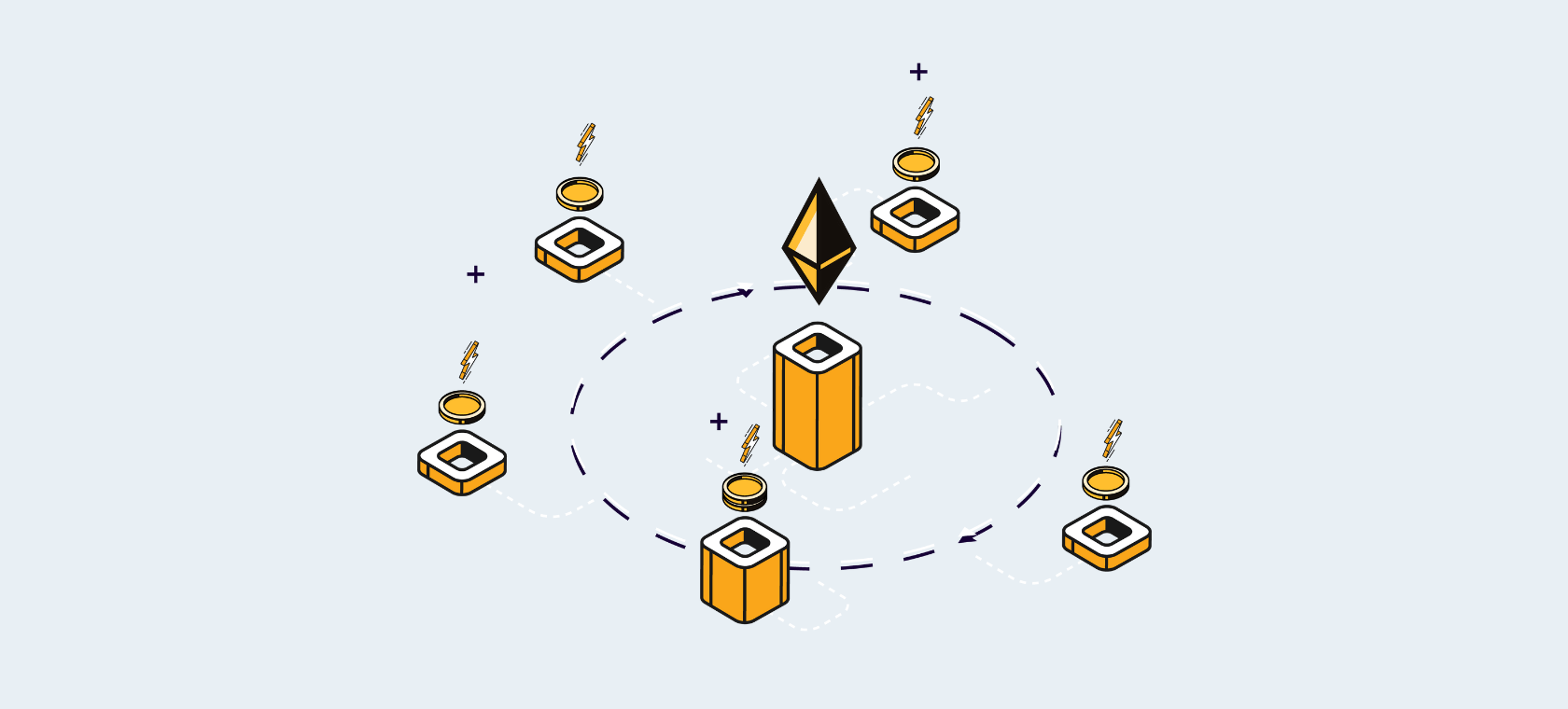

In the Proof-of-Stake mechanism, a person who wants a chance to be a validator must first invest a certain number of his own cryptocurrencies and lock them for a certain period.

This process is known to many as "staking."

The reason for this approach is safety.

Locked coins are some sort of guarantee that validators will follow the rules of the network and validate transactions once the network chooses them.

If a validator wants to do something outside of the network’s rules, let’s say create fraudulent transactions, he/she will lose the locked coins and the role of the validator.

The process of choosing the validator

The number of coins locked in a staking pool can, in some way, be a determining factor when selecting the validator in the Proof-of-Stake mechanism.

But, to avoid the situation where the network selects only the validators with the highest amount of coins staked, Proof-of-Stake uses additional selection methods.

This is why the mechanism also takes into consideration longevity (the time period in which the coins were staked) and randomization.

Validators that lock cryptocurrencies in a pool for a long time are considered trustworthy.

Proof-of-Work vs. Proof-of-Stake - advantages and disadvantages

Both mechanisms have an identical goal, which is to maintain the integrity of the blockchain network But, they do it in different ways.

Proof-of-Work and Proof-of-Stake successfully perform these tasks, but each has its own advantages and disadvantages.

As we have already mentioned, the biggest difference is manifested in energy consumption and the choice of the validator.

These characteristics will help you easily to distinguish Proof-of-Work from the Proof-of-Stake mechanism.

| Proof-of-Work (POW) | Proof-of-Stake (POS) |

|---|---|

| New blocks are added by miners | New blocks are added by validators |

| Participants must buy highly effective computer equipment to participate | Participants must stake (lock) their own coins in the pool to participate |

| Consumes a lot of energy | It is energy efficient |

| Higher level of security | Secure, but it has security flaws. |

| Miners receive block rewards (in a form of new coins) | Validators receive percentage of a transaction fee |

Which cryptocurrencies use Proof-of-Stake (POS) mechanism?

A large number of new crypto projects select Proof-of-Stake as the main form of consensus mechanism within the blockchain network.

Last year, the second largest cryptocurrency Ethereum also switched from Proof-of-Work to the Proof-of-Stake mechanism.

The five most popular cryptocurrencies that use the Proof-of-Stake mechanism besides Ethereum are:

Proof-of-Stake is a very flexible mechanism.

This is why most blockchain projects adapt it to their needs.

This is how some derivatives were created over time. For example, there are:

- Delegated Proof of Stake (DPos)

- Nominated Proof of Stake (NPos)

3 main advantages of the Proof-of-Stake mechanism

When it comes to maintaining the blockchain network, Proof-of-Stake has numerous advantages over the Proof-of-Work mechanism.

These are the reasons why they most often choose Proof-of-Stake:

1. Better scalability

Proof-of-Stake is accessible to a large number of people as it allows anyone to become a validator.

You don’t have to invest in cutting-edge mining devices. This is important because the more people use the network and participate as validators, the more powerful the network becomes.

If the network becomes stronger, transactions become much faster, and most importantly, the whole process becomes much cheaper.

2. Decentralization

The larger number of validators within the network, chosen randomly to confirm transactions, means the network becomes more decentralized in management.

3. Energy efficiency

Unlike the Proof-of-Work mechanism, where huge mining farms use a lot of electricity, Proof-of-Stake uses less power since the validator can validate transactions with a smartphone or personal computer.

3 main disadvantages of the Proof-of-Stake mechanism

1. Safety

Many consider that Proof-of-Work offers better security than Proof-of-Stake. Critics say that Proof-of-Stake powered blockchain wouldn’t be able to withstand the hypothetical 51% attack.

In theory, if the token (in a Proof-of-Stake powered blockchain network) has a small price and a small market cap, and the price crashes further, someone can buy 50% of the total supply and practically control the network.

2. The possibility of centralization

Most proof-of-Stake blockchains have a clear set-up amount of coins a person needs to stake in the pool to become a validator.

For example, in the Ethereum network, you have to lock 32 ETH in a staking pool. What if there is a project where the amount of coins you have to stake is not clearly set?

There is a fear that this type of network could easily favor the validators with the highest number of coins stakes in the pool. The system would automatically cease to be accessible to everyone as it would favor only several validators.

3. The matter of accessibility

There are critics who question the affordability of participating as a validator in the Proof-of-Stake mechanism.

If you want to become a validator, the first step would be to stake some coins in the pool. If you don’t have the coins of the native network, you must first buy them.

Although it sounds simple, consider the example we gave earlier. In order to become a validator in the Ethereum network, you need to lock 32 ETH for a certain period.

If you don't have that many ETH coins, you have to buy them, and at the time of writing, 32 ETH is worth about 49313.28 Euros, which is not affordable for everyone.

Of course, there is an alternative for users who can’t afford that many coins.

Users who have a certain number of ETH coins can join other small amount holders in one common "pool."

Together, they lock their ETH tokens (to reach the 32 ETH range) and act as one validator in the network.

3 frequently asked questions about proof-of-Stake (POS)

1. How to mine Proof-of-Stake cryptocurrencies?

Cryptocurrencies that use the Proof-of-Stake mechanism cannot be mined. Mining is a process specific to Proof-of-Work cryptocurrencies like Bitcoin or Litecoin.

There are no miners in the Proof-of-Stake mechanism.

To confirm transactions, that is, to add new blocks to the blockchain, the name "forging" is used, which in our country would be translated as forging.

2. How can I earn Proof-of-Stake cryptocurrencies?

According to their mechanism, you must become a validator in the blockchain network through the staking process and participate in maintaining the network’s integrity.

If the network selects you to validate transactions, you can get a reward (it is usually a percentage of a transaction fee).

3. Can a Proof-of-Work network become Proof-of-Stake?

It is possible for the network to switch from one mechanism.

However, such a change is very complex and would require the approval of all validators in the network and then years of work until successful implementation.

The recent example is Ethereum network, which switched from a Proof-of-Work system to Proof-of-Stake years after the first announcement.